Authored by Matthew Piepenburg via GoldSwitzerland.com,

As I write this from a France making ever more bold moves toward forced vaccination, one can’t help but ponder the broader issues of centralized government control, regardless of one’s take on vaccine or no vaccine.

Focusing on financial rather than viral data, the evidence of centralized state control over natural market forces in the stock and bond markets is becoming increasingly incontrovertible.

We’ve written elsewhere about the death of logic and the madness of crowds. It should therefore come as little surprise that the death of truth is yet another casualty of the increased central control we are experiencing in global markets.

Debt Crisis Disguised as a Health Black Swan

Long before COVID reared its highly controversial head (from viral source debates, baby-with-bathwater policy reactions, censored science as to vaccine efficacy and safety, distorted math on infection rates vs death rates, and centralized government control by officials acting “for your own safety” vs. Constitutional and legal issues of individual choice), the global financial system was already in an undeniable as well as unsustainable debt crisis.

As any one who can fog a mirror and read history in the same breath also knows, whenever a debt crisis is obvious, what follows is equally obvious: an economic crisis, then a political crisis, and from there a social crisis.

In short, and from ancient Rome to 1917 Russia, or 1789 France to 1933 Germany, debt matters.

Debt is a very dangerous thing to economies and societies, and always climaxes with more centralized control in its wake.

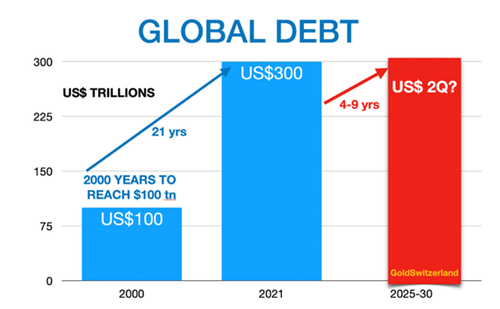

The problem for the 21st century, however, is that almost no global policymaker (left, right or center, European, Asian or American) wanted to touch this $280T debt elephant in the room.

Instead, they buried their heads for years in the sand and sought re-election with promises paid for with, alas, more debt.

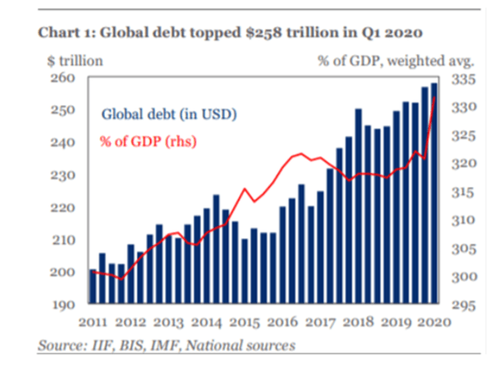

In this openly embarrassing backdrop (long before COVID), economic orthodoxy had been tossed into a corner as governments around the world took on fatal debt levels like this:

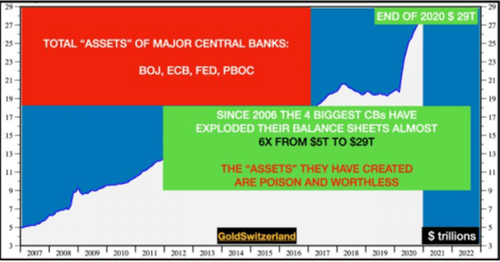

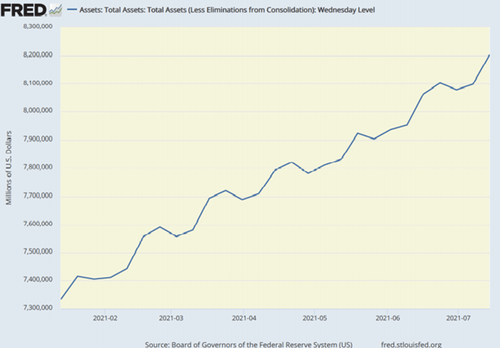

…paid for (i.e., “monetized”) with mouse-click fiat money like this…

But rather than face or confess the sins of a system already on its debt-broken knees, the financial and political actors responsible for the pre-COVID debt disaster had a convenient tale to tell.

A Convenient Lie

That is, and almost as if on demand, along came the tale of all tales, the patsy of all patsies, the blame of all blames, and the excuse of all excuses: COVID.

That is, if we thought economic orthodoxy (i.e., living within one’s national means, valuing valuations or honoring free market price discovery) had been tossed into a corner pre-COVID, well, the post-COVID backdrop essentially murdered economic orthodoxy completely.

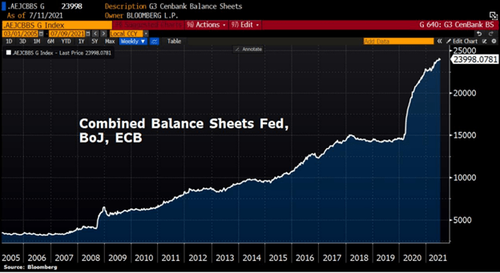

Today, we have global debt rising exponentially…

…as well global central banks printing more fiat currencies parabolically:

New Rules Hiding Old Failures and “Fuzzy Economics”

COVID paved a sad new road to what Antoine van Agtmael described as “fuzzy economics”—namely a financial panopticon in which governments worldwide have literally gorged themselves on ever more debt in a secular paradigm shift toward greater centralized control over our economic, personal, social, political and foreign policies.

From vaccines to banking regulations, lockdowns to melt-ups, individuals and markets are now adapting to a new set of desperate rules in the wake of the equally desperate failures of prior financial policies.

a. Governmental Guarantees of Commercial Bank Loans

To this end, I have spoken with Russell Napier at length (and written at length)on these new rules, which involve new sets of governmental/centralized control euphemistically described as “support,” including governmental (and highly inflationary) guarantees of commercial bank loans.

This massive game-changer (and open signal of increasing centralized control) effectively went unnoticed by the Main Stream Media, whatever stream that is…

b. Warnings from a Fed Governor: Governments Doubling Down

Yet even before blunt geniuses like Napier clarified this narrative, some of the less blunt and far less genius policy makers themselves could no longer hide or deny their own mistakes, all of which pointed toward new rules, “new order” and hence new mistakes to come.

In May of 2015, for example, former Fed governor Larry Lindsay was already confessing that “the financial arrangements of the state are no longer sustainable,” and that a new paradigm awaited us.

He went on to say that, “it is not a pretty change if we get there, and it is a matter of political liberty because a government will NOT voluntarily let itself go out of business…it will use all its powers available… to fund itself.”

Imagine that.

The sad fact is that just because governments have immense power, this by no means implies immense wisdom, character, accountability or even math skills.

The new rules now involve a financial system already heading toward an open confession of Wall Street socialism and a Federal Reserve which is now effectively, if not entirely, financing the U.S. government.

Centralized Government Controls = Deliberate Inflation

As Russell Napier, a one-time staunch deflationist, now argues, these new rules all point to more inflation ahead, which is the ultimate gut-punch to an already over-controlled and dying middle-class—i.e., the real world.

But for nations drowning in debt, deliberate inflation is one way to print away that burden.

Bond Markets Decoupled from Reality

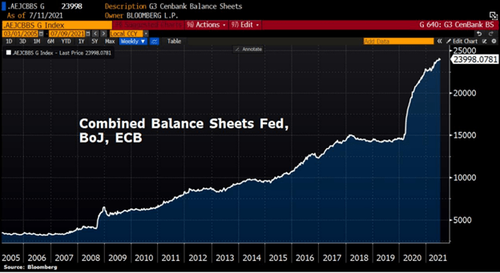

Meanwhile, in this new abnormal of increased centralized control over our lives, markets and economies, the Fed can create money like this in the span of months…

…in order to purchase the vast bulk of otherwise unwanted IOUs from Uncle Sam—i.e., Treasury bonds.

Such “policy,” of course, artificially suppresses Treasury yields (which go down as central bank supported bond prices go up).

This explains why yields have sunk to levels which in no way reflect where yields would otherwise be in a free market confronting undeniable as well as rising inflation (which the Fed still refuses to acknowledge).

But as for inflation, Napier once again reminds: “Have we ever seen a country in history persistently running a broad money growth rate at 10% that didn’t have inflation at 4% or above? The answer is no.”

Of course, the U.S. is hardly alone in drinking its own debt Kool-Aide, and if you still need more evidence of who is buying the world’s major governments bonds, it’s simply their own central(ized) banks:

Truth Dies as Centralized Government Controls Rise

In short, control has not only distorted markets, it has distorted truth, and in the same breath, distorted any sense of trust in centralized “leadership” and/or credibility, which like real bond yields, grows more negative by the day.

As Napier has said elsewhere, “bond yields are decoupled from inflation,” which is a polite way of saying that bond yields in particular, like the bond market in general, is an open lie.

Stocks Decoupled from Reality

Speaking of “decoupling” from reality in the wake of the “new rules” emerging from increasing centralized controls (economic, social and political), the stock market is no less of an open lie than the overtly subsidized bond market.

After all, stocks love a generous central bank, one becoming more central to our financial lives with each passing day, mouse-click and newly “printed” dollar.

Hard to believe?

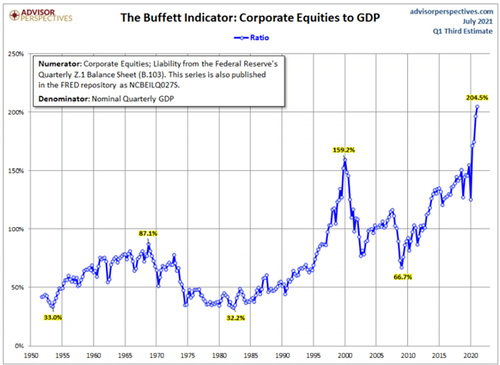

Then ask Warren Buffett’s infamous stock market valuation metric which measures total equity market cap as a percentage of GDP.

As the graph below confirms, about the only thing growing under centralized control and its “new rules” is the mother of all stock bubbles.

The “centralizers” in bed with the debt-drunk politicos call this “promising market growth” resulting from “accommodation,” but anyone who tracks markets already knows that debt-driven, money-printed “growth” is not growth at all—it’s merely a centralized aberration, as well as an open insult to natural market forces.

More to the point, such top-heavy (and artificial) market predominance within U.S. GDP screams of an open charade, and graphs like the Buffett Indicator above are just one more reason to distrust a centralized system which has now fully devolved from free market to free prevarication.

Pretty Words to Hide Scary Math

Centralizers may be dishonest and openly distortive, but like all politically self-interested profiles, they are masters at putting lipstick on a pig through euphemistic word choice, of which “quantitative easing,” “stimulus,” “accommodation,” “MMT,” and “recovery’ are all classic examples.

But there’s more…

“Climate Change” Policies—Wise Altruism or Just More Centralized Control?

As for further examples of the creative use of language to hide truth, it may come as a surprise to any of us who care about the planet that the sudden politicized interest in “climate change” may not be as altruistic or progressive as the politico’s would like you to believe.

In a global backdrop of debt-driven desperation and increased centralization, leaders thirsty for any way to build credibility would have us admire their green initiative; but the real driver behind their plans may be less green than oil-colored.

With all the inflationary forces colliding (extreme money supply expansion, fiscal deficits, governmental guarantees etc.), the last thing our not-so-trusted leaders want to confess is that oil prices, and oil supply, may be signaling an end to cheap oil.

Rather than confess the myriad economic and political shock waves of a “peak oil” event, the powers that be would rather use “climate change” to justify their suddenly important war against fossil fuels to mask a pivot toward ever more centralized government control of your thinking and your energy consumption.

Earlier in July, for example, the Financial Times announced that “in order for sustainable finance to work, we will need Central Planning.”

Really? Wonderful, more central planning.

This blunt declaration was made in regard to the EU’s new sustainable finance strategy and Green Bond Standard aimed at creating the first climate-neutral continent by 2050.

Sounds noble? Who wouldn’t love “climate neutral”?

But why does sustainable finance and climate neutrality require central planning?

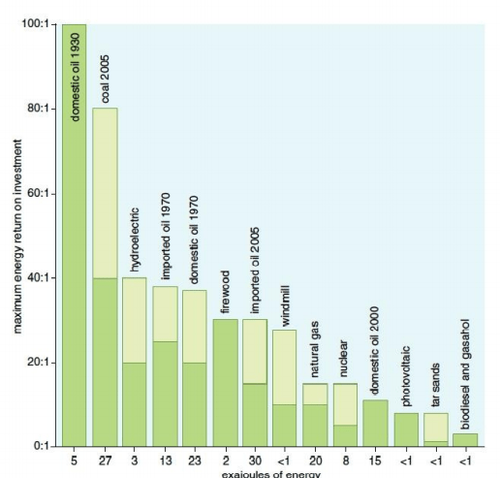

What’s likely being deliberately censored from this initiative is that troublesome little notion so in danger today, namely allowing free markets to decide which energy sources provide the highest “Energy Return on Invested Energy” (EROIE).

Needless to say, when it comes to “bang for your buck” the best energy “rate of return” still comes from those pesky fossil fuels not windmills or nuclear reactors.

Needless to say, if free market forces were in actual play, participants would use of the cheapest, most cost-efficient source for energy, again: Fossil fuels.

Making headlines today, however, are global policymakers (from Yellen to the IEA) endeavoring (nobly?) to gut-punch interest in fossil fuels.

The IEA has openly stated they want energy groups to stop producing oil and gas by 2050.

But again: Is the motive truly noble? Is this about the environment? The planet’s safety? Or something else?

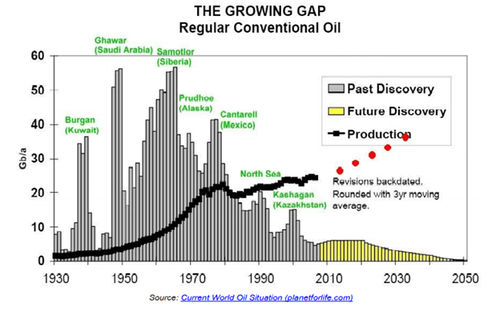

Cynically (and I am a cynic), there may be a darker problem beneath the surface of this political shine, including the fact that the oil production beneath the surface of that same planet has not moved much at all in the last decade.

In other words, has the world reached peak oil?

Are policy makers deliberately attacking the free market use of energy sources to save the planet, or do they secretly believe peak oil (namely peak “cheap” oil) is a stark reality against which policy makers must now take extreme action?

In sum, is “climate change” a politically correct ruse used to mask the much darker reality that “peak oil” is upon us, which would have a drastic impact on debt markets, geopolitics (think Saudi Arabia), and inflation (skyrocketing)?

Certainly, “climate change” offers far better political optics than “peak oil” headlines and all that it would portend should affordable oil become a distant memory.

More Centralization + More Spending + More Inflation = More Need to Prepare

As I wrote in a book published just weeks before the COVID outbreak, the financial system was already and openly Rigged to Fail well before a pandemic became the new pretext for once unthinkable governmental influence (i.e., centralized control) over our markets and private lives.

The evidence of increasing centralization is all around us, yet in an increasingly politicized media which effectively parrots (rather than questions) governmental policy, what is entirely absent is increasingly open and public debate (as well as math) on everything from COVID policy to monetary policy.

Regardless of whether you feel governments are centralizing to benefit or control your future, the means to that centralized end will demand further spending, further debt-onboarding and hence further distortion of credit, equity, real estate and currency markets.

As for currencies, be they paper, digitalized CBDC or some hybrid, informed investors recognized long ago that they will not be real stores of value, and hence the road ahead will certainly favor precious metals, as just about everything else “precious” about free markets and national currencies is behind us.

Needless to say, this explains why some of the largest and most recent buyers of gold are the global central banks (Russia, Hungary, Brazil…) themselves.

Just saying…