Source: Zero Hedge

The CPI data came in higher than expected again in May. Looking at the trend, this should cast some serious doubt on the notion that inflation is “transitory.”

Price data has come out hotter than expected every month this year. But the market reaction appears to be the exact opposite. The worse than expected CPI report seems to have reinforced the “inflation is transitory” narrative. As Peter Schiff explained in his podcast, everybody is buying into a lie the Fed is spoon-feeding us.

People seem to be even more confident now that inflation is transitory than they were before we got all this really bad data.”

The stock market was up last Friday after investors had time to absorb the data, and growth stocks did better than value stocks – something you would not expect in an inflationary environment. Long-term bond yields fell after the CPI data came out, and the dollar rallied. In other words, despite the news that the dollar is losing purchasing power faster than expected, people wanted to buy dollars. Meanwhile, gold sold off on Friday and continued that trend to start the week Monday.

The reality is, when you have inflation, what really should be happening is investors should be selling dollars because they’re losing value. They should be selling bonds even faster because they represent dollars in the future, which will be worth even less than dollars in the present. And you should be buying gold as a hedge against that inflation.”

We’re seeing the opposite and Peter said it doesn’t make any sense.

In the long run, anybody who actually understands the significance of what’s going on would be taking advantage of these market moves to sell dollars into the rally and buy gold into the dip because the bigger moves obviously are going to be down in the dollar, way down in US Treasuries, which represent future payments of dollars, and a big move up in gold.”

The question is how is it that we got this worse than expected CPI data and yet everybody is more convinced than ever that inflation is transitory? Peter said he thinks a lot of it has to do with the fact that the financial media did a full-court press to try to convince everybody that what they’re seeing is an aberration and that the Fed is correct in that the inflation we’re experiencing is just a transitory result of the reopening and it’s all going to disappear.

In fact, the Fed has to pretend inflation is transitory because they have no ability to do anything about it.

They can’t contain inflation because they put themselves in that box. The country now has so much debt thanks to their prior monetary mistakes; we now have all this debt because rates have been so low for so long that if the Fed were to actually raise interest rates to fight inflation, they would create a much worse financial crisis than the one that they helped to create in 2008. Only this time, there couldn’t even be any bailouts because the Fed would be fighting inflation and therefore raising rates, and therefore unable to finance any government bailout effort for any segment of the economy. So, obviously, that’s politically off the table. So, since the Fed can’t fight inflation, it has to pretend that inflation is not a threat.”

If the Fed admitted that it can’t inflation, that would create even bigger problems.

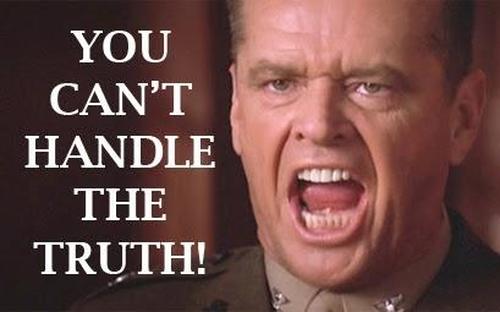

So, the last thing it can do is tell the truth because it knows, like Jack Nicholson knew, we can’t handle the truth. So, they spoon-feed us a lie.”

Peter goes on to explain how the mainstream financial media is spinning the data to back up the Fed’s false narrative. It’s like a little kid justifying a bad report card. Running with that analogy, Peter said the Fed is getting an F in monetary policy.