Source: Zero Hedge

We warned over the weekend that ‘things just got ugly for crypto in Washington, D.C.’ as the government aimed to partially cover the cost of its massive infrastructure bill by taxing crypto companies… and the entire industry will feel it.

“This is not a drill,” writes Jake Chervinsky, an influential crypto lawyer and a sober voices in a hype-prone industry. In a must-read Twitter thread, Chervinsky explains how the $550 billion bill – which is primarily about roads and bridges – could shiv American crypto companies.

The pain comes in the part of the bill that explains how the U.S. will help pay for those roads and bridge. Namely, the bill states that Uncle Sam plans to cover $28 billion of the costs by squeezing crypto brokers.

The trouble is that the bill defines “broker” – a term normally used to describe the likes of Coinbase and Robinhood – as basically any business that touches crypto.

The uproar in the crypto industry (and likely their freshly minted lobbyists) sparked a bipartisan amendment which would de-fang the cryptocurrency provision.

Senators Ron Wyden (D-OR), Cynthia Lummis (R-WY), and Pat Toomey (R-PA) have introduced an amendment that would exempt Bitcoin miners and validators on other blockchain networks from a provision aimed at raising $28 billion in tax revenue to help pay for the bill.

I’m thrilled to say that @RonWyden @CynthiaMLummis and @SenToomey have introduced an amendment to explicitly exclude validators, hardware and software wallet makers, and protocol devs from the tax reporting provisions. Bravo! Now we have to get this thing passed. pic.twitter.com/0mpyNzxXee

— Jerry Brito (@jerrybrito) August 4, 2021

Coinbase CEO Brian Armstrong joined the debate yesterday, urging crypto market participants to reach out to their representatives over the over-reaching surveillance and disclosure requirements of the hastily put-together and ill-conceived new infrastructure bill’s crypto-based pay-fors.

1/ If you’ve been following threads on the Infrastructure bill, you know that there is a hastily conceived provision related to digital assets. This provision could have a profound negative impact on crypto in the US and unintentionally push more innovation offshore.

— Brian Armstrong (@brian_armstrong) August 4, 2021

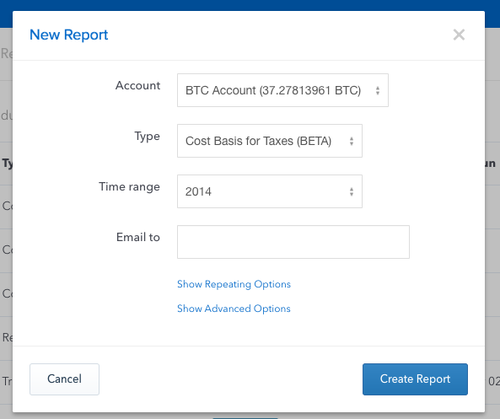

Armstrong went to to note that Coinbase is happy to help customers fulfill tax obligations just like the rest of the financial services industry. We’ve been doing this for years, and issuing more 1099s is a great idea: Coinbase and the IRS

But the bill defines “brokers” to include anyone who “effectuates transfers of digital assets.”

This means almost anyone in the crypto ecosystem (miners, validators, smart contracts, open source developers etc) could be treated as a “broker” with massive reporting obligations.

This makes no sense.

Smart contracts, for instance, are not companies, and cannot be modified to collect KYC info or issue 1099s. They are simply software running on the blockchain that anyone can use.

Fortunately senators @RonWyden, @SenToomey, @SenLummis have an amendment that narrows the definition to intermediaries like @coinbase, who actually have the capacity to report, just like in the traditional financial system.

Full Amendment here:

The infrastructure bill also imposes sweeping and unprecedented reporting requirements that will force exchanges like Coinbase and others to surveil its customer’s transactions in a way that is more intrusive than the rest of traditional finance…

All we ask for is an even playing field with traditional finance that doesn’t penalize cryptocurrency unfairly.

Policymakers play a critical role in ensuring that tech innovation can flourish in the United States. I hope that they keep this in mind and don’t impose draconian burdens on an industry that will play a major role in the innovative future of our country.

This will not happen without your elected reps hearing from you.

Please contact your senators and ask them to support the amendment to the infrastructure bill proposed by @RonWyden, @SenToomey and @SenLummis (which gets us part way there by narrowing the definition of broker).

We also need to ask all senators to remove the language requiring sweeping surveillance of crypto holders.

You can use this tool to contact your senators (click image for link).

Thank you!