Source: Zero Hedge

Authored by Mike Shedlock via MishTalk.com,

Financially Hobbled for Life

Unable to discharge debts in bankruptcy, students with useless degrees, especially master’s degrees are Financially Hobbled for Life.

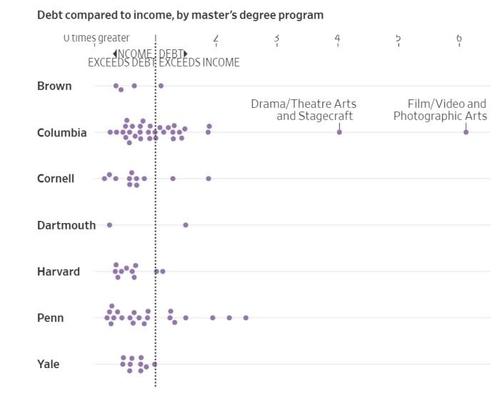

Recent film program graduates of Columbia University who took out federal student loans had a median debt of $181,000. Yet two years after earning their master’s degrees, half of the borrowers were making less than $30,000 a year.

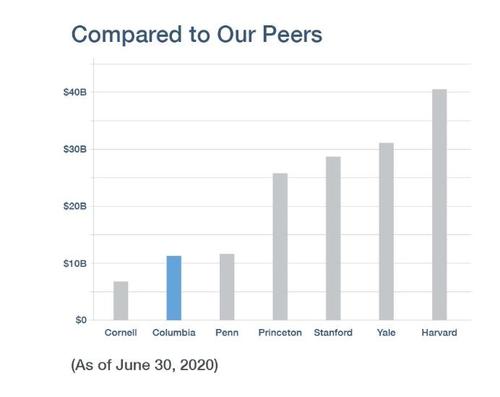

The university is among the world’s most prestigious schools, and its $11.3 billion endowment ranks it the nation’s eighth wealthiest private school.

Lured by the aura of degrees from top-flight institutions, many master’s students at universities across the U.S. took on debt beyond what their pay would support, the Journal analysis of federal data on borrowers found. At Columbia, such students graduated from programs including history, social work and architecture.

Undergraduate students for years have faced ballooning loan balances. But now it is graduate students who are accruing the most onerous debt loads. Unlike undergraduate loans, the federal Grad Plus loan program has no fixed limit on how much grad students can borrow—money that can be used for tuition, fees and living expenses.

Panic Attack

“There’s always those 2 a.m. panic attacks where you’re thinking, ‘How the hell am I ever going to pay this off?’ ” said 29-year-old Zack Morrison, of New Jersey, who earned a Master of Fine Arts in film from Columbia in 2018 and praised the quality of the program. His graduate school loan balance now stands at nearly $300,000, including accrued interest. He has been earning between $30,000 and $50,000 a year from work as a Hollywood assistant and such side gigs as commercial video production and photography.

“We were told by the establishment our whole lives this was the way to jump social classes,” said Matt Black of an Ivy League education. Instead, he said he feels such goals as marriage, children and owning a home are out of reach.

Grant Bromley, 28, accumulated $115,000 in federal loans while getting his Master of Arts in film and media studies at Columbia. Mr. Bromley earns around $16 an hour and can’t afford to pay down his loan balance, which is $156,000, including undergraduate debt and interest. “It’s a number so large that it doesn’t necessarily feel real,” he said.

Highly selective universities have benefited from free-flowing federal loan money, and with demand for spots far exceeding supply, the schools have been able to raise tuition largely unchecked. The power of legacy branding lets prestigious universities say, in effect, that their degrees are worth whatever they charge.

Who’s Offering Useless Master’s Degrees?

The answer is the same as who’s offering useless degrees in general: They all do.

Where the heck is someone with a master’s degree in stagecraft, art, history, political science, photography, English, foreign language, culinary arts, etc., etc., etc., supposed to get a job that will pay the bills?

A few will get lucky, the rest will be financially hobbled for life.

Dear President Biden, You Need an Education, Starting With the Meaning of “Free”

I had no idea the above article was coming out today. Yet, I mentioned an aspect of it yesterday in Dear President Biden, You Need an Education, Starting With the Meaning of “Free”

George W. Bush signed the “Bankruptcy Reform Act of 2005” making student debt uncancellable in bankruptcy. Guess what happend?

Biden’s solution of course is a “free” money student debt forgiveness program.

Student debt is not dischargeable in bankruptcy so the cost of programs soared along with the willingness of universities to promote useless degrees for the masses.

Administrators and teachers who make more when enrolments rise piled on. And of course the unions piled on encouragements in need of money to support ridiculous pensions.

With the money pouring in, the salaries of football coaches and administrators soared.

Don’t forget mainstream media parroting the need for everyone to get a degree with no mention ever that most degrees are worthless.

Endowments

Columbia University compares its endowment program to that of other bigger schools. Donate, donate, donate is the mantral.

Don’t Donate a Penny!

Endowment money is not for students, it’s a slush fund for administrators, coaches, and their pension plans.

Solutions

- At the individual level, don’t go deep into debt for useless degrees.

- Study overseas where costs are much cheaper

- Free courses, some really are free, but you don’t get the college credit

- More competition

- Accredited online universities

- Free College Courses

- Pension reform

- Better use of endowments to help the students

- Alternative education programs

- Bankruptcy reform

- Require universities to go over typical graduating salaries and costs of their programs.

Biden’s Free Education Program

Instead of doing anything that makes any sense, Biden’s proposes “free education” as does Elizabeth Warren and Progressives in general.

The problem is “free” someone is paying for the building, the teachers, the coaches, the staff, the administrators, and the pension plans.

Make it “free” and there is no limit on any of the above.

“Free” is the typical proposal, but “free” is never the solution in practice.

Mish