Source: Zero Hedge

Authored by Mike Shedlock via MishTalk.com,

A temporary improvement in Illinois’ finances just hit a brick wall…

Illinois’ Temporary Improvement

Thanks to Congressional handouts passed in reconciliation with zero Republican votes, Illinois will receive $13.2 billion in federal funding it can spend over the next three fiscal years.

Supposedly the money was for pandemic-related expenses, but money is fungible. Illinois can use that money for anything, including pension bailouts.

In addition to the free money, Illinois passed tax hikes estimated to bring in $666 million in revenue annually.

Finally, Illinois borrowed billions from the Fed to pay down its backlog on unpaid claims. The 3% rate to the Fed is a huge reduction to the 12% statutory prompt payment penalty rate that Illinois paid vendors.

Getting current on unpaid bills sounds great, but it’s about to end.

Illinois Headed for Fiscal Cliff

Please consider State Heading for Fiscal Cliff When Pandemic Relief Ends by Ralph Martire and Arthur Rubloff.

The biggest takeaway from the fiscal 2022 general-fund budget is no different than the 20 or so that preceded it: Illinois does not have the fiscal capacity to continue funding the same level of core services it provides today into the future. Period.

The reason Illinois keeps struggling to maintain general-fund spending on core services over time is simple: The state’s existing mix of taxes and their respective structures are so flawed that they simply do not work in a modern economy and instead have created a “structural deficit.” This is when annual revenue growth is not sufficient to cover the cost of providing the same level of public services from one fiscal year into the next, adjusting solely for changes in inflation and population — even during a normal, non-pandemic economy.

So when the pandemic ends and enhanced federal financial assistance ends with it, Illinois will face a significant fiscal cliff that will significantly impair its capacity to continue investing in any of the four core service areas without enacting the structural tax-policy reforms — yes, that does mean tax increases — needed to create long-term revenue generation that grows with the economy.

Martire is executive director of the Center for Tax and Budget Accountability, a bipartisan fiscal-policy think tank. He’s also Professor of Public Policy at Roosevelt University in Chicago.

Illinois FY 2022 Liabilities of the State Employees Group Health

A reader who understands Illinois Penalty Debt sent me a link to Illinois FY 2022 Liabilities of the State Employees Group Health.

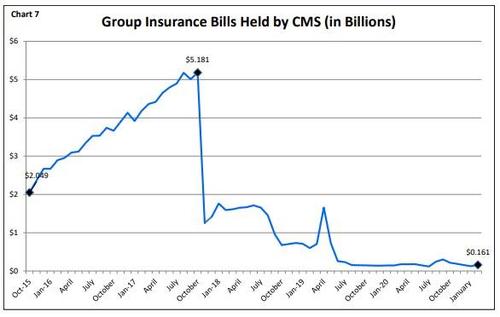

Group Insurance Debt Held

At the end of October 2017, the State had approximately $5.181 billion in health insurance claims waiting to be paid out. However, in November 2017, a bond sale was issued to pay down SEGIP and Medicaid bills. The bond proceeds were used to pay off approximately $3.982 billion in held group insurance bills, bringing the total bills held by Illinois to $1.256 billion at the end of November 2017. This total has fluctuated since that time, but has trended downward in recent months.

Hooray, Illinois paid its bills, finally, at least group insurance, mostly by floating bonds. In Illinois, using debt to pay debt is the norm. What now?

My Reader Comments

The Illinois Comptroller, among others, has been crowing in recent weeks about how current the state is on paying its bills, that the backlog is down to about $3.5B, or 30 days.

They got here by borrowing billions from the Fed to pay down the backlog (which was smart since paying 3% to the Fed is cheaper than paying the 12% statutory prompt payment penalty rate!). Plus, they ‘borrowed’ about $1B from other state funds that had excess cash and used the cash to pay down the bill backlog.

On page 19 it says that CMS is going to take the ‘hold’ on the group health bills up from the present 30/60 days all the way out to 5 months. But the report doesn’t say why. For this, I had to contact CMS to ask why. The bottom line is apparently the Comptroller has spent the available money and is now cash constrained. So their response is that CMS is going to sit on the bills for 5 months before sending them over to the IOC to be paid.

Illinois Budget Text (Page 19)

In regard to payment cycles, the 2022 fiscal year is projected to continue the hold cycle currently in place for the 2021 fiscal year at somewhat longer durations for bills in question. The projected FY 2022 claims hold cycles are:

– AETNA claims: 156 days

– Managed Care claims: Approximately 5 months

– OAP/Prescription claims: 160 days

– Dental claims: 156 days for network claims, 216 days for non-network claims

Holding the Bills “Somewhat Longer”

Somewhat longer means going from 30/60 days to as much as 5 months at the penalty interest rate of 12%.

People Flee Illinois

I am one of those who left.

On October 5, 2019 I informed readers Escape Illinois: Get The Hell Out Now, We Are.

On July 10, 2020 I announced success in It Takes 3 Weeks to Escape Illinois

Questions of the Day

Q1: Why 3 weeks? Because that’s how long it takes to reserve a one-way U-Haul outbound.

Q2: What are Biden and the Fed going to do for an encore to allow Illinois to kick the can further?

The answer to Q2 remains to be seen, but if I was Illinois I would suggest not counting on more money from Congress.

Meanwhile, expect more tax hikes and more people to leave the state in response.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.